STUDENTS: Quick Tips, Cheats and Short-cuts!

Students Acronyms – Tips – Pairs to Trade & Tricks …

[op_liveeditor_element data-style=””][text_block style=”undefined” align=”left”]The students courses cover most of the important points to get you well on your way to becoming a very successful and highly long-term consistent trader.

There are however other little tips and tricks that every trader needs to know about that will help you.

These are little things like the best markets and FX pairs to trade, when are the best times to make trades and more importantly; when you should be staying out of the markets.

This quick cheat sheet is a super handy for you as it gives some very handy links including the major acronyms we use here in the site and in the FSO tribe forum, you will learn how BUFFERS work when making entries exit which is SUPER IMPORTANT.

So keep that in mind if you get stuck in the future you can just flip back to this tips lesson.

Using Spreads

When trading Price Action signals such as the Pin Bar or the Engulfing Bar it is always highest probability to set our entry at the break of the candle so price can confirm the trade.

Taking our entries from the break will save you from entering trades that never confirm themselves by breaking through. Taking our entry at the break means that nearly all our entries will be set as pending orders and not market orders.

Often price will find Support or Resistance at the very tops or bottoms of the candle. This is why it is very important to make sure our entry is set above or below the candle high/low.(if unsure what I am talking about – refer back to course #1)

We never want to be caught out entering trades before price has broken due to the pip spread the broker has on each pair. We must always be aware of what the spread is on each pair and factor it into our entries and exits. THIS IS CRUCIAL!

EXAMPLE SCENARIO: The spread on the GBPJPY on many brokers can quickly widen out to 10 pips. We see a pin bar to go long on the daily chart.

The high of the pin bar is 121.25. To enter this setup we need to take into account that the spread is 10 pips and we must add that onto our entry price so we don’t get entered before price has actually broken through the top of the pin bar.

If we don’t add the pip spread into our equations and just set our order to go long 1 pip above the high of the pin bar, we will actually be entered when price gets to 121.16, not 121.26 where the top of the pin is.

If you don’t understand that last part, then re-read it a few times because it is absolutely critical and if you still don’t get it jump straight into the forum and post up your question, or send us your question.

Using Buffers

This would be effectively taking an entry before the pin bar has been broken because when going long we pay the pip spread upfront. Along with the 10 pips spread we must also add on a buffer which ensures the entry signal has definitely broken before we enter.

In this example our entry to go long would be 121.25 + 10 pips for spread and another 10 pips for the buffer. Our pending order would be set for 121.45.

This would safely enter us into a trade when the pin is definitely broken to go long.

Each timeframe needs a different buffer. The longer the timeframe the bigger the buffer needs to be.

Examples of possible buffers are:

Weekly Chart: 10-20 pips

Daily Chart: 5-10 pips

4hr Chart: 4-8 pips 1hr Chart: 2-4 pips The more volatile the pair the more the buffer should be. It is here that people start to become confused.

Each trade you will only pay the spread once.

You will not pay both on entry and exit but only EVER once.

So the whole trade i,e; enter or exit will incur the spread once only. With this in mind we always have to add the buffer to all entries, but we do not have to always add the spread.

The spread needs to only be added when we are buying. This does not matter if you are taking profit or being stopped out. If you are buying you will pay the spread.

When you sell you do not pay the spread or need to factor it in along with the buffer.

An example is if you go long. Because you are buying you are going to pay the spread. In this trade when you go to either exit by being stopped or taking profit you will be selling and you DO NOT pay the spread, so you do not need to add it to you stop and targets.

If you were to take a short trade and sell you are not paying the spread one entry. When you either get stopped or take profit you will pay the spread as you are buying back to exit the position.

You always pay the spread when you buy. So when setting orders in the future make sure you add not only the buffer but also the spread to all buy actions. When selling, the buffer only needs to be added. You also need to apply buffers to your stops.

This is exactly the same theory as using buffers for entry. You need to make sure your stop level has been breached.

For example; if your stop level is above or below the high/low of the pin bar, by using a buffer you would be ensuring that price is definitely breached the high/low of the pin bar.

However; you do not need to use buffers on your targets – you make your target precise and you make sure where they are set they are 100% correct the first time!

GLOSSARY OF TERMS:

FSO = Forex School Online

The Full FSO Glossary of Terms & Acronyms Can be Found Here …

Managing Trades When Trading Against the Trend

When trading with the trend it can be very profitable to get into a wave in that trend and just ride it until the trend ends.

When trading against the trend however, trading in most cases is short lived. The reason for this is because when going against the trend we are only trading the pullbacks.

Novice and beginner traders are advised to stick to only trading with the trend. The reason for this is because to be a successful counter-trader takes a real amount of discipline to wait for the best trades to come along.

It is far easier to just not trade any trades against the trend at all, then it is to try and pick what are the trade to be in and out of.

The other skill that is learned over time is taking profit and learning to do it when the market is giving it to you and even though your greed is shouting you want more, your counter-trend plan is telling you that you need to cash your profits.

New traders can find it hard to have the discipline to take profit when the market makes it available.

When looking to enter trades against the trend, only major Support and Resistance zones should be used to trade off. Once in the trade, traders should be wary of any area that could see the original trend prevail and be prepared to take action.

Trading against the trend can be very profitable when the trader keeps in mind that they will have to act a lot faster than when trading with the trend.

Traders must be prepared to move to break even and take profit when the market gives them a chance.

If you can keep these things in mind and never let greed and temptation get in the way causing you to hold trades for longer than you should, trading against the trend should be super profitable.

Trading Around News Events

As price action traders we don’t look at the news or pay any attention to the news outcomes.

What we do though is watch the price action on the charts which is just the news events being interpreted on the charts.

Most traders at first do not understand this comprehensively and if this is you, let me it explain …

Price Action traders never want to try and guess any news events or place any trades based of announcements. It is our job as traders to have a profitable edge in the market and every time we see that edge we pull the trigger every time without hesitation.

To understand this you have to understand how a currencies price moves; price moves because other traders or organizations buy or sell.

Price does not move up or down because of news. News does not make price go up or down itself.

For example; a country changes their interest rates and that does not automatically make the countries currencies price change. The only way the price is going to change is if people or traders go into the market and and trade it. This is the only way.

Traders have to go into the market and buy/sell to make the price go up and down. News or announcements or talks by major world figures don’t directly do anything to price at all itself.

They may indirectly make a trader think about how he wants to do with his money or trade a certain way or a bank may push their order another way etc,.

This is why it is so common for traders to be watching the news and they will be expecting something to happen and the complete opposite happens.

For example; they may be watching the Non Farm Payroll in the US. A bad results comes out and so they sell the USD expecting that the USD to go down, when in fact they start watching the USD go rocketing up.

This happens all the time and the reason for this is; the news does not move the market. The people trading the market are who move the market.

This is another reason why trading the news simply does not work. Even if you do guess the correct announcement or results, it has already been factored into the price and in many cases price goes the opposite way to what was expected. This is why we trade price.

The only time I personally do not trade is moving into the Non Farm Payroll. This is the first Friday of the month each month. Other than that I will take every trade on every time frame I see.

I do not look at the news calendar at all or follow any economic news. I am a price action trader. Price action gives of foot prints and clues. Price Action is just showing what price has done on a chart for traders to see. Price will often give clues that traders can switch onto before news comes out.

For example; before the Non Farm Payroll (NFP), price on the US pairs will often go really quiet and start making indecision candles or small nothing candles.

Obviously when traders start seeing small indecision candles they are not going to start making trades and this how trades will often be avoided right before the NFP is announced without the trader even knowing it, just following the price action.

The Best Forex Pairs & Other Markets to Trade – in Order!

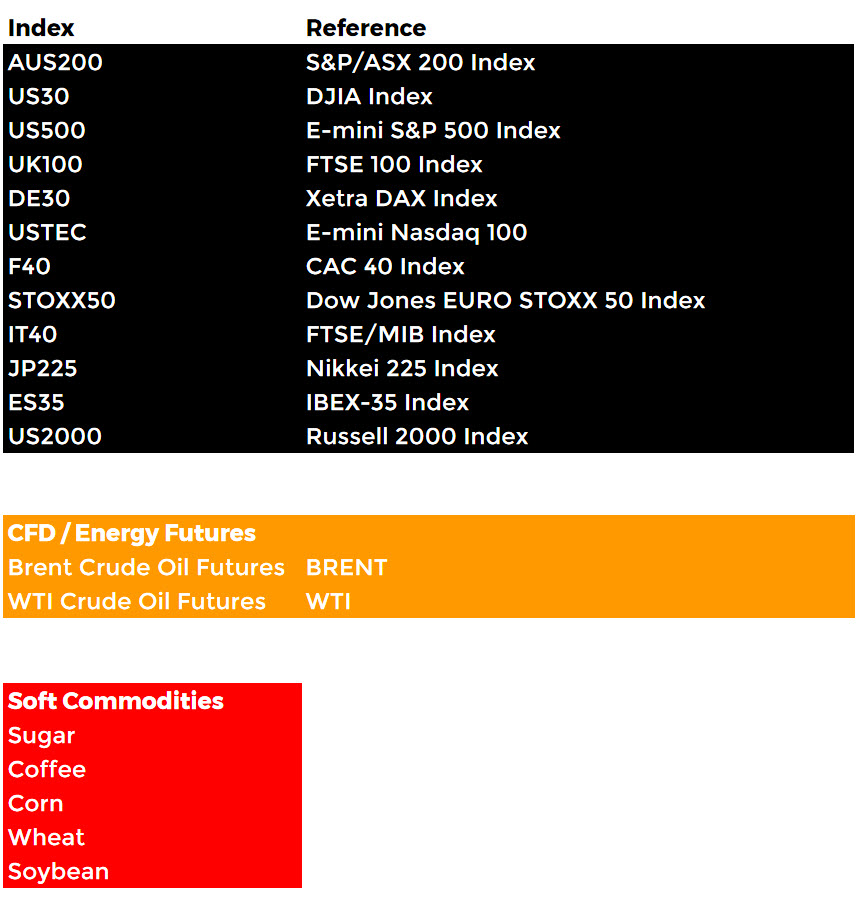

You can find the full list of Forex pairs, futures and stock indices in the order of how advanced they are to trade and when they should be added to your watch / trade list HERE.

Government Intervention

Government intervention is something that all traders need to be aware of and keep in mind. It is not something I focus a massive amount of attention on, but it something you do need to think about with things like JPY interventions – Swiss banking.

The hard part for all Forex traders is there is no way to know if or when any government will intervene to manipulate the price of their currency.

That is why I do not focus on it. I instead put in place the safety protocols I have discuss all through the courses and instead focus on creating a trading edge as should you and when you see / head government intervention like we could obviously see a few years back on the EURCHF we avoid like.

Splitting Orders and Trades Into Positions

Inside the two price action courses we teach members how to manage their trades with a high probability method that is high on protecting capital.

To use this method, traders need to know how to split their trades and use MT4 correctly if they are indeed using MT4 or just manage their orders correctly if they are using another platform.

MT4 and MT5 do not allow traders to take profit with pending orders.

What this means for us is that if we enter a trade – we cannot then split that trade up with a pending order to take profit, we could only take the whole position as profit. For example; if I enter a 90,000 trade, I then cannot set a pending order to exit 30,000 profit at my first profit target.

I have to exit that whole 90,000 trade as a whole trade. That may be no good for me because I may have 3 x profit targets, or I may want to take a little profit at the first area and then let the rest run into the next major support or resistance area etc,.

So I can manage the way I choose to, what I do is “I split my positions”.

Before continuing I need to make a few things really clear … this is not increasing risk – this is not increasing your spread and this is not increasing your commissions.

You are going to take the EXACT SAME AMOUNT of trade or some worth of trade, however instead of taking them in 1 x position and only then being able to set 1 x pending profit target, you may choose to ‘split’ it up into 2 or 3.

For example; that 90,000 trade I just had above that I could not manage the way I wanted to, the next time around I could instead enter the same 90,000 HOWEVER enter 3 x 30,000 = 90,000.

This way I could manage anyway I choose to. I could still take 100% profit of the full 90,000 at the first profit, but I now have the choice to take only 30,000 as a pending order whilst I am not there at the computer and then move the rest to breakeven.

Another option… enter 30,000 – 60,000 split if you only want 2 x positions to manage. It is up to you!

It’s about being smart, having options and leaving your options open so you can manage for further profits.

The Best Times To Trade and More Importantly When NOT to Trade

The best times to trade are when the markets are its most volatile.

Traders are often scared of volatility, but volatility is exactly what traders need to make money and without it traders are without opportunities.

The biggest volatility comes when the two biggest sessions overlap during the UK and US sessions. Because we are looking at higher timeframes we are looking to the 4hr charts and above. It is critical we don’t get caught out on smaller false breaks.

The best 4hr candles to get into are the 4hr candles that form during the UK and US sessions. This is when ¾ of the daily Forex trading is pushed through for the day.

Sometimes more important than when to trade is when NOT to trade because this is when traders can really get caught out. It could pay to write these down and remember them. Traders should avoid trading;

- The last two 4hr candle of the week

- Any intraday candles Monday until the UK opens

- Hold off opening daily trades on Monday for the first 1hr

Traders need to avoid the last 2x 4hr candles of the trading week. These are more often than not sucker candles.

These candles will often throw up reversal candles such as Pin Bars, but rather than be true market reversals, they are more often than not traders taking profit for the week and getting out of the market.

When the market opens the following week these traders normally get back in the price continues on and if traders have gotten into the trader they get run over. These need to be avoided.

The same goes for trading on Monday mornings before the big guys wake in the UK. The markets open in Asia before the big guys in the UK and US do and the markets are very thin.

Trading anything before the big players have put their money back into the market is not a smart play unless it is a timeframe on the daily or above. When the markets first open for the week they can be a little crazy. The first 1hr the spreads will be very wide and this can catch people out.

If you have spotted a trade on the daily or weekly chart from the previous Friday you want to put on, wait at the minimum 1hr for the market to calm down and for the spreads to go back to normal and the market to gain back its liquidity and then place your orders.

Making Only Plan & Trading Journal

Make sure you have your trading plan in order with clearly defined and well set out rules. Get your example plan HERE.

To backup your trading plan is your trading journal. This is what will help you pick up errors before they actually become problems. Your journal will become the document that you will be able to look back on and see how you became a true success through, but ONLY if you consistently fill it out!

Get your students trading journal HERE!

Safe trading and all the success!

Johnathon[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]