[op_liveeditor_element data-style=””]

LESSON: Using Price Action Reversals to Trade False Breaks

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]In previous sections we have covered reversal signals such as Pin Bar, Two Bars and Engulfing Bars. Traders can use these reversal signals at the false break area to dramatically increase their chances of placing a winning trade. Quite often these reversal signals will be the candle that creates the false break.

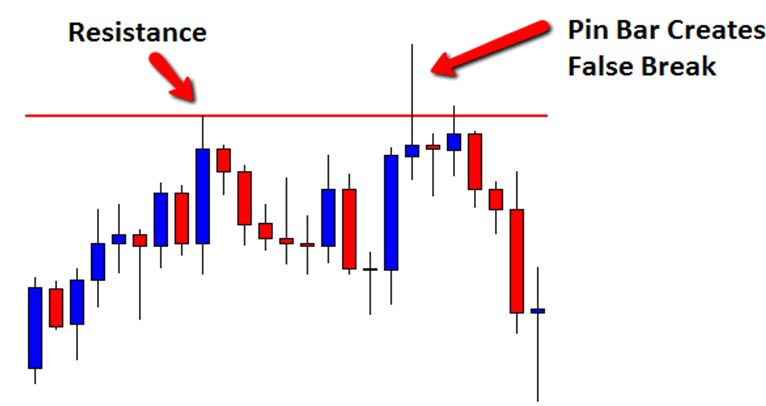

Example of Pin Bar Creating False Break

Many times price will break out only by a small margin. This is normally enough for “break out” traders to have their entry opened. This small break can often become the nose of the Pin Bar when price snaps back in the opposite direction.

The following example shows a Pin Bar creating a false break out of resistance. Traders could have waited for this false break to occur before entering the Pin Bar short once the low of the Pin Bar was taken out.

Chart Example:

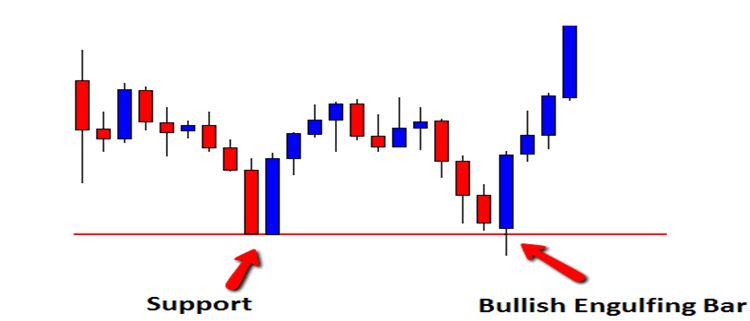

Example of Engulfing Bar Creating False Break

The following example shows how a trader can use an Engulfing Bar to enter false breaks. Entering off a large false break with large Price Action signals such as this Engulfing Bar is a way to increase your winning chances.

Note how price broke below the support area before whipping back the other way creating a Bullish Engulfing Bar. This was a clear signal that whilst price did go lower the bulls won the battle and were in control. This is very solid hint that higher prices were likely.

Also take note of how the false break was only small but was still a break of a clear support level.

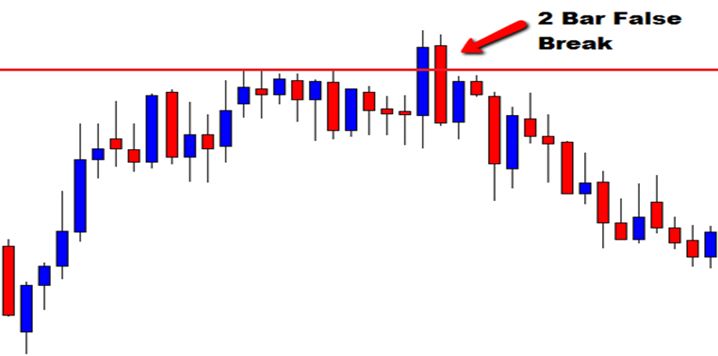

Example of 2 Bar Reversal Creating False Break

The last example shows a 2 bar reversal creating the false break. Two bar reversals quite often trick breakout players when they see the first bar break out and close either above or below an important area.

It is super important when entering Two Bar reversals that create false breaks you wait for the high or low to break and confirm before you enter.

Note in this example price clearly broke higher before whipping back in the opposite direction producing a very clear false break.

Lastly…

False breaks are a great way for traders to enter and get on the right side of the market. You can wait for the market to show its hand and then move in-line with the contrarian traders, back in the opposite direction to the breakout.

Combining other signals at false break levels is a very good way for traders to not only increase their winning trade chances,but also to define their risk.

Make sure to watch the video lesson below![/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Nine

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 11 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”15″ font_font=”Montserrat” font_color=”%237e7e7e” bottom_margin=”16″]

Action Steps & Downloads / Links

[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

Watch Video Lesson

[/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]