[op_liveeditor_element data-style=””]

LESSON: The Longer the Build up the Better

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]When looking to play a breakout trade the longer that price has wound up and been in consolidation mode normally the bigger the breakout will be.

Quite often you will see price winding up with successive inside bars or small indecision candles.

When this happens we can look for price to potentially act like a spring, with the longer and harder it gets squeezed up, the bigger the force of the breakout.

The other factor is how long a support or resistance level has held. The longer it takes price to break through normally the bigger the breakout will be. Every time a support or resistance level is tested it gets a little weaker.

The reason for this is support and resistance is where other traders have their orders to enter the market. Every time a level is hit it takes more and more orders out of the market. Eventually when there are not enough orders to hold the level, price will make the breakout.

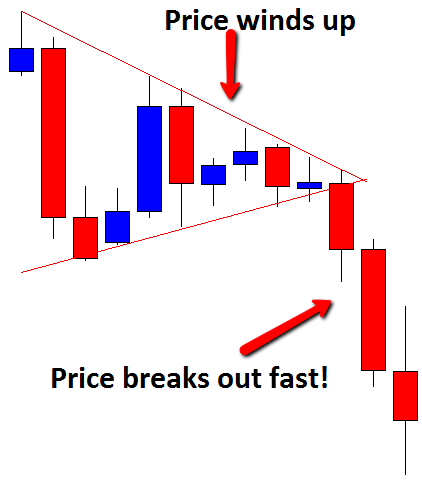

CHART EXAMPLE #1:

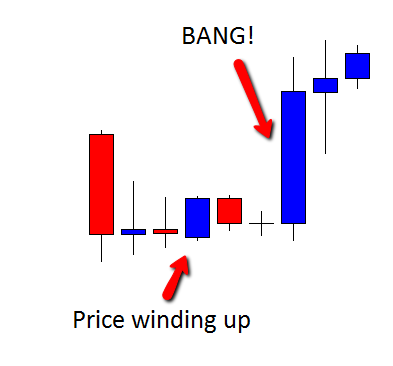

The following two examples show price winding up tighter and tighter. We know the longer this goes on the harder the breakout will be. When the breakout occurs price explodes.

CHART EXAMPLE #2:

[/text_block][/op_liveeditor_element]

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module One

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 5 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]