[op_liveeditor_element data-style=””]

LESSON: The Inside Bar

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237E7E7E”]

Inside Bar

The Inside Bar is a very flexible signal. The Inside Bar signifies that the market is neither bullish nor bearish and that control of the market hangs in the balance.

The Inside Bar can be used as both a reversal signal and as a continuation signal when managing trades.

Managing Trades

When in a trade the Inside Bar can be an extremely handy signal to have formed the trader’s way.

With the correct knowledge the trader can use the Inside Bar to tighten stops and protect their capital or look for bigger targets.

Once the Inside Bar has formed, price has then got to break out one way or another. A break out against the trader’s trade direction could signal an end to price moving in their favor. If price breaks from the Inside bar favorably price would most likely look to continue on in the original direction. With this in mind a trader could move their stop to above or below the Inside Bar to protect their capital.

CHART EXAMPLE #1:

With the example below the trader had entered a short trade on a bearish Pin Bar. The trader was then up a nice profit.

Looking for ways to manage this trade the trader spotted an inside bar form. The trader then pulled their stop from above the high of the Pin Bar to above the high of the preceding bar of the inside bar. This way if the inside bar broke out higher the trader had locked in their profit. As it happened in this example price broke out of the inside bar lower and the trader banked more profit whilst at the same time locking in and protecting their capital.

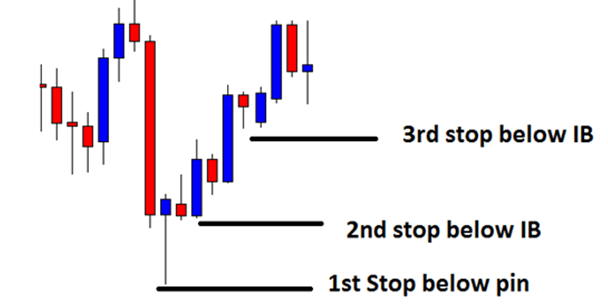

CHART EXAMPLE #2:

The next example is of a bullish Pin Bar.

This example shows how a trader could use this method to manage a trade over a period of two Inside Bars for a great profit.

The trader starts with their stop below the Pin Bar. Price moves up and forms an Inside Bar giving the trader a chance to move their stop almost to break even.

Price then moves up and again produces an Inside Bar. The trader then has a chance to move their stop to lock in more profit and protect capital.

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Four

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 8 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]