[op_liveeditor_element data-style=””]

LESSON: Position Sizing

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]Position sizing is all about working out how much to risk each trade.

Basically, before entering each trade you need to know exactly how big in $ / lots the trade is you are putting on.

Working this out before the trade ensures that the trader is risking the same percentage of their account each and every time they make a trade and it ensures they stay in the game even if they hit a string of losses. This is trading with money management.

After the trader has decided how much they wish to risk each trade, it is important that they then before entering each trade work out how much the position size should be.

Money, Units & Lots

Every trade a trader will enter will have a different sized stop. If a trader is to enter the same amount on every trade no matter what the size stop is, they would be risking vastly different amounts of money and different percentages of their account every single trade.

For example, if a trader puts a 50,000 trade on with a 20 pip stop, they are risking twice as much as if they enter the same 50,000 with a 10 pip stop.

So a trader can enter every trade risking either the same amount of money or the same percentage of their account for every trade, position sizing is used.

Using position sizing ensures that a trader will be able to place a trade and risk the same percentage of their account whether the stop is 200 pips or two pips. This also ensures that no matter how small the trader’s accounts are, they can play trades with large stops, providing their brokers allow them to use leverage and small units.

To work out the position size before each trade we use what is called a position size calculator which can be found here: Position Size Calculator

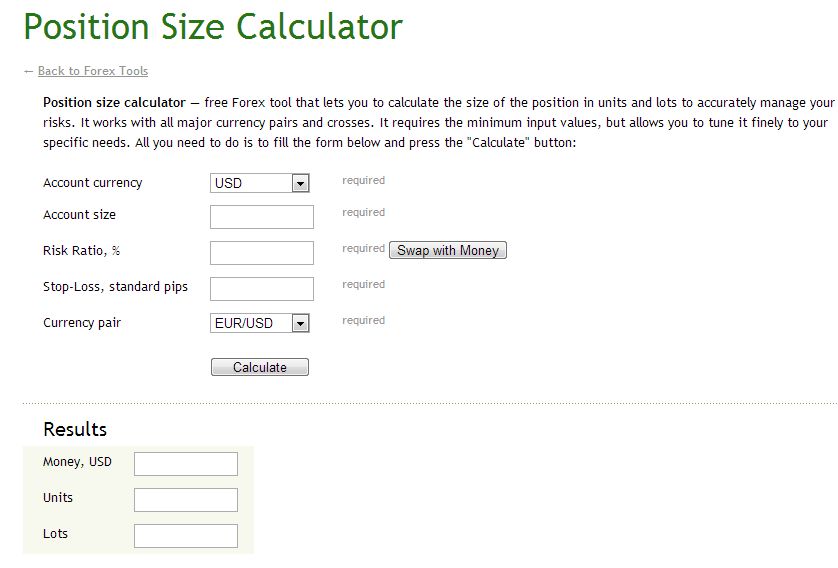

The calculator will ask the following questions which will need to be filled in:

- account currency (the currency of your trading account)

- account size (your trading account size in $)

- risk ratio is either % or $ (how much in $ or % you want to risk)

- stop loss in pips (how big your stop is in pips)

- currency pair (the pair you are trading price)

After these questions are filled into the calculator, you will be given an amount you need to trade to risk and the amount you input into the risk section.

The results will come back as: Money (how much money you are risking in this trade), Units and Lots (how big your trade size is in units and lots).

This is the amount you will then open a trade with. For example; if the calculator comes back with Money: 200 Units: 20,000 and Lots: 0.2 it means you will be opening a trade for 0.2 lots. One full standard lot or standard contract is 100,000, so 0.2 lots of one standard lot are 20,000.

A picture of what the position size calculator looks like below:

Special Note: Make sure that you put the price of the market / FX pair that the calculator asks for and not the pair you are trading or any other pair!

This can have catastrophic consequences if you do not enter in what the calculator is asking you for.

It will cause you to be WAY over in some cases double or way under what you thought you were going to be risking. Double check your math after you get your results back.

EXAMPLE SCENARIO – BIG STOP AND STILL TRADING

Trader Bill has a $5,000 account and is prepared to risk 3% of his account which is $150.

Bill checks out the charts and see’s the EURUSD has a daily setup with a stop of 300 pips. Bill then works out how many lots he is allowed to trade using a positing size calculator that will allow him to still only risk $150 of his account but still trade with a 300 pip stop.

If Bill wanted to make this 300 pip trade and only risk $50, then he would put that into his calculator.

Trader Bill works out that he can open a trade with a position size of 0.5 mini lots. Each 1 pip movement will be worth $0.50.

The next day Trader Bill finds a 4 hour setup on the EURUSD that he is looking to enter with a 50 pip stop. Trader Bill always only risks 3% of he’s account on all trades, so again he works out the amount of lots required to trade that allows him to risk $150 and have a 50 pip stop.

Trader bill works out that in this trade he can afford to trade 3 mini lots and still only be risking $150. Each pip movement in this trade will be worth $3.00.

As you can see from the previous example it is all about money risked and gained and not pips. When working out your position sizing and profit always work in $ not pips.[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Twelve

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 4 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

Action Steps & Downloads / Links

[/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]