[op_liveeditor_element data-style=””]

LESSON: Making a Pre-Trade Plan

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”17″ font_font=”Montserrat” top_margin=”-40″]

As traders we are in this business to make a profit and one of the hardest factors we have to deal with is greed and fear. These two trading emotions are never more a factor then when managing a trade.

The best way to deal with these emotions and to manage trades in a methodical and logical manner is by producing a pre-trade plan.

What is it?

A pre-trade plan is a plan that a trader writes down exactly how they are going to manage their trade. As soon as a trader spots a trade they would begin to work out their trade position sizing to work out how big their trade size is going to be.

More in trade sizing is below in the course. After the trader has worked this out they would start to work on their trade plan. Before entering or setting any orders the trader needs to assess all the key levels and FRA/FSA.

In the pre-trade plan the trader needs to write out exactly how they are going to manage the trade using the levels of the trade and the methods that they have now been taught.

The reason we manage trades this way and don’t simply enter trades and then make it up as we go along is because once you are in a trade you are less likely to make good decisions. The best decisions are going to be made when you don’t have any money on the line and when you have a clear mind and can see things from the sidelines.

Once you are in a trade and your account balance is going up and down you are prone to jumping at shadows and not simply doing what is best. By making a pre-trade plan using the logical levels before you have entered the trade, all you then have to do is let price do its thing and execute the plan.

[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”17″ font_font=”Montserrat”]

Example 1 of a pre-trade plan:

- Pair: Long EURUSD

- Entry: 1.25

- Stop: 1.15

- FRA: 1.35

- First Target: 1.45

- Second Target: 1.55

Notes: Once price moves higher into the FRA I will move the whole position to break even to protect capital, but will not take any profit. I have two profit targets for this plan which are listed above.

[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”17″ font_font=”Montserrat”]

Example 2 of a pre-trade plan:

- Pair: Short AUDNZD

- Entry: 1.45

- Stop: 1.55

- FSA: 1.38

- Target: 1: 1.30

Notes: Once price moves into the FSA I will take 50% profit and will move the other 50% of the trade to break even. I will then look to take the other 50% profit off at 1.30.[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”17″ font_font=”Montserrat”]

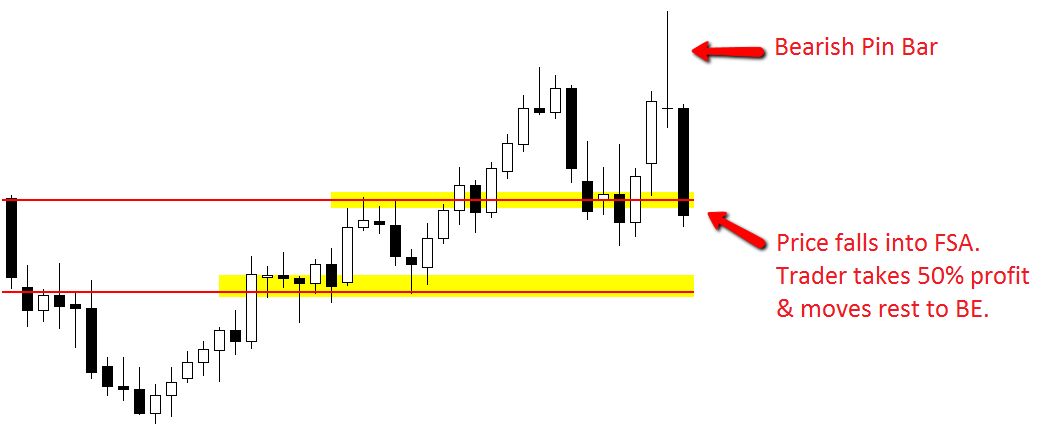

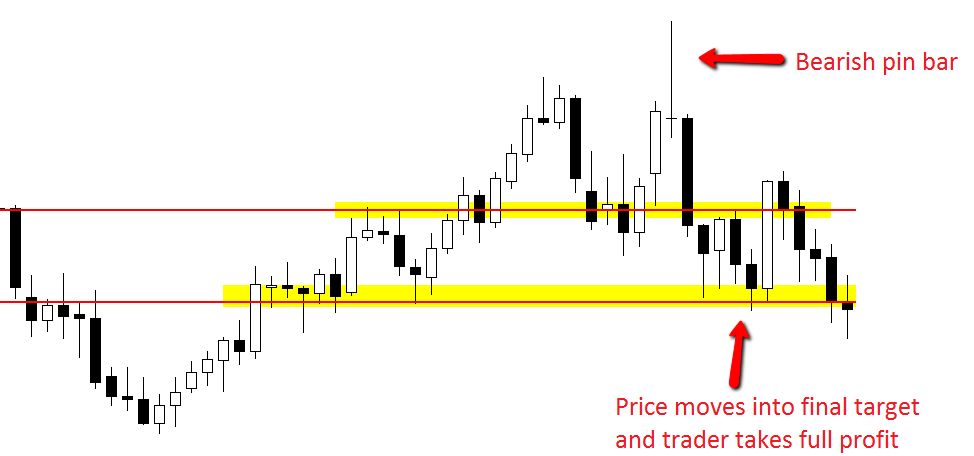

Pre-Trade Example

Your pre-trade plans should be as detailed as possible. All you want to have to do as the trader is carry out the plan. Once the trade is placed, your job as a trader is to just carry out the plan. “Plan your trade and then trade your plan”

- Pair: Short XYZ from bearish pin bar

- Entry: 1.20

- Stop: 1.35

- FSA: 1.14

- Target: 1.03

Notes: When price moves into the FSA I am going to take 50% profit and move the rest of the trade to breakeven. I will then look to take the other 50% profit off the table at the next profit target I have set which is 1.03.

Chart examples below:

Chart 2:

[/text_block][/op_liveeditor_element]

[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”17″ font_font=”Montserrat”]

Recap

Anyone can place a winning trade. It takes absolutely zero skill to place a winning trade. It takes a lot of skill and discipline however to consistently make profits in the ever changing markets.

The trader that doesn’t manage their trades smartly will blow many accounts and will follow the pattern of boom and bust. In other words; they will have big wins and highs, followed by even bigger losses that kill their account/s.

One of the reasons that more traders fail than succeed is because traders spend more time focusing on their entries than they do on their trade management and profit taking.

You can go to any Forex forum on the internet and look where 90% of the traders are hanging out and it will be without a doubt in the “Forex systems” area, and all of the traders are looking for a new system that gives them new criteria to “Enter” the market.

You look at all the conversations in the forums and blogs around the net and the signal services etc and they are all based around where to “enter” the market!

What many of these traders are failing to realise is that they most likely already could have been profitable traders with many of the systems and methods they were using if they had of worked on their trade management and profit taking skills.

You can have the best trading entry method in the world, but if you cannot manage trades and take profit effectively then you will still make no money.

Making profit is not done at the entry, but at the end when you closeout the trade and if you are consistently watching trades go from being in winning positions to then stopping you out for losses, then clearly something is wrong.

Create it, Plan it – DO IT!

The hardest part to trading Forex & Futures is not in the placing the trades, but in the managing and more importantly taking profit. This is also the reason you will find most other Forex mentors and coaches will not discuss the management of a trade and how to take profit. Instead they stick to the very easy part of placing trades.

In this part of the course you have learned an advanced method of managing trades and looking after your capital, however once practiced this method does become second nature. From here on in you must start writing a pre-trade plan. This MUST become a part of your pre-trading ritual.

If you want consistent trading results, then the only way to get them is to manage your trade consistently and the only way to do that is to manage your trades the same way every time. You can’t do that if every time you go into a trade and make it up as you go along.

Making a plan ensures you make the best decisions and ensures you take profit in a cool, calm and businesslike manner.

Like everything in this course you must now practice and demo before you are comfortable to implement in your live account.[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[/custom_html][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Ten

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 20 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

Action Steps & Downloads / Links

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

Complete Module Test

[/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]