[op_liveeditor_element data-style=””]

LESSON: Examples of 2 Bar Reversals in play

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]The 2 bar reversal is basically a pin bar that has formed over two sessions instead of one.

A 2 bar reversal has the same psychology and make up as a pin bar, but whereas a pin bar manages to reverse in the same session to form a one candle pin bar, the 2 bar reversal takes two sessions to complete the reversal.

Both the pin bar and 2 bar reversal are telling us (the price action trader) the same information. Both price action signals are showing that price moved into an area and found support/resistance before snapping back the other way.

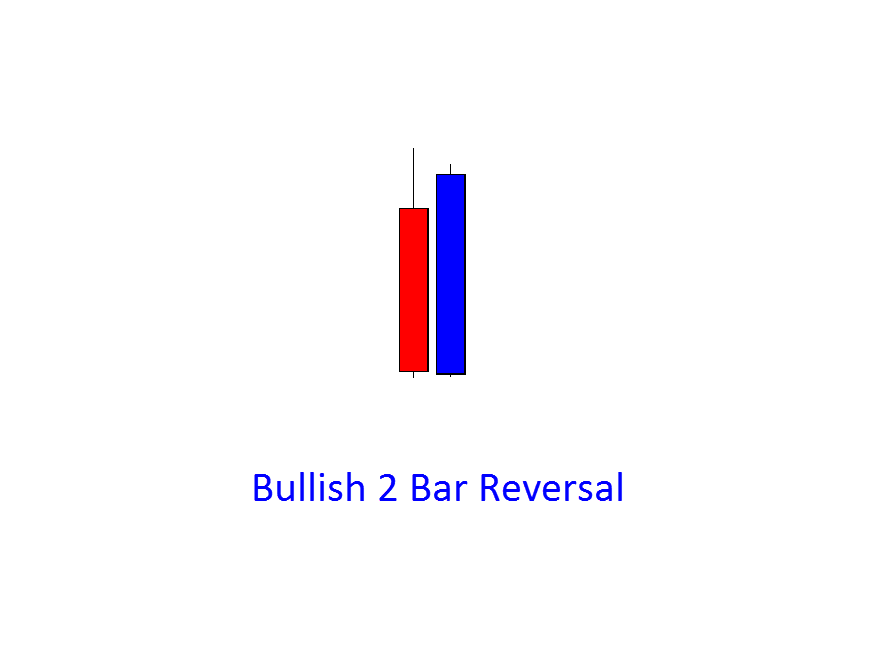

For the 2 bar reversal we are looking for the same components as what we would with a pin bar. The one difference for the 2 bar reversal is the second candle of the 2 bar should close either above or below the first candle.

For a bullish 2 bar reversal to be tradeable it needs to close above the first candles open and for the bearish 2 bar reversal to be tradeable it needs to close below the first candles open.

They do not need to close above/below the wicks of the candles, just above/below the opens.

We enter and play our stops exactly the same on the 2 bar reversal as we do a pin bar.

Please refer to the pin bar section.

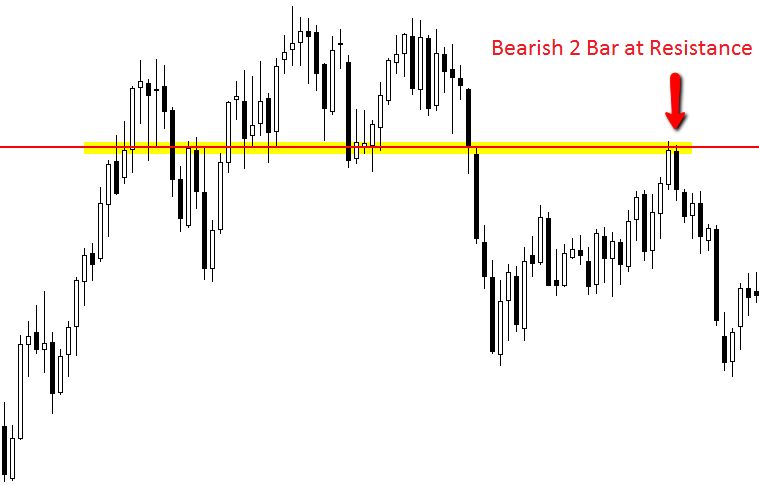

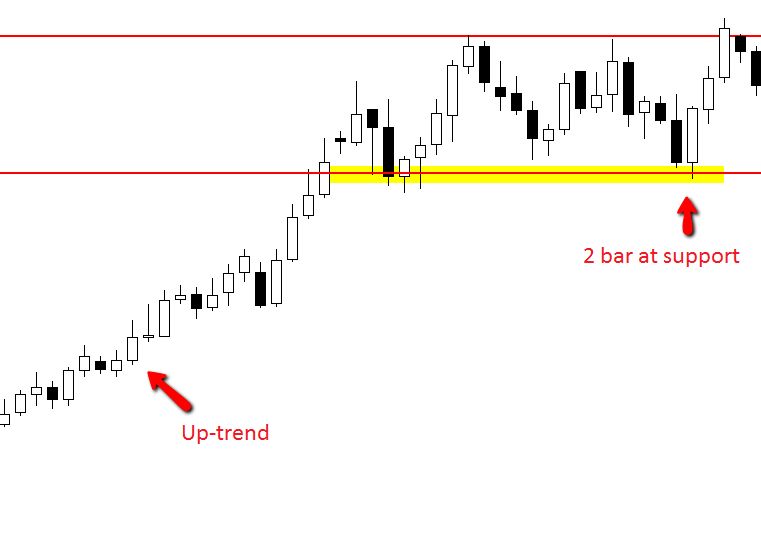

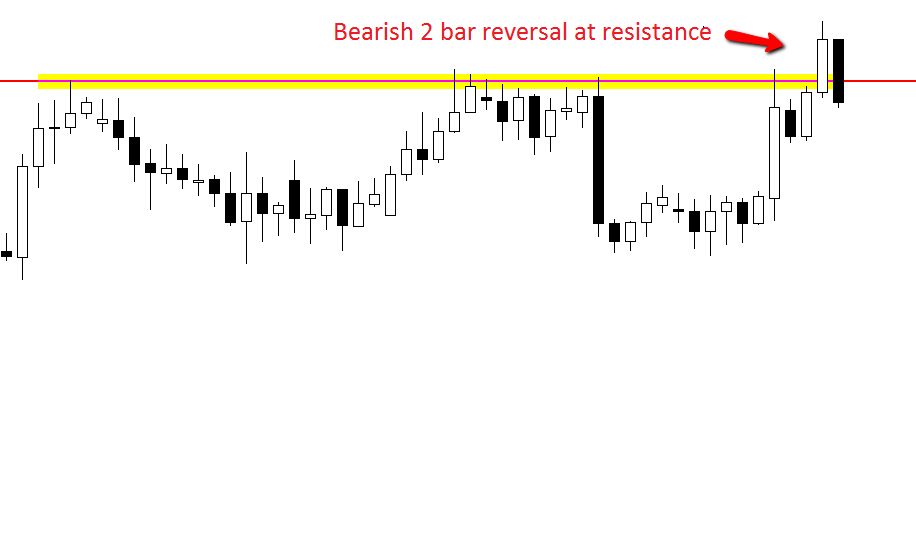

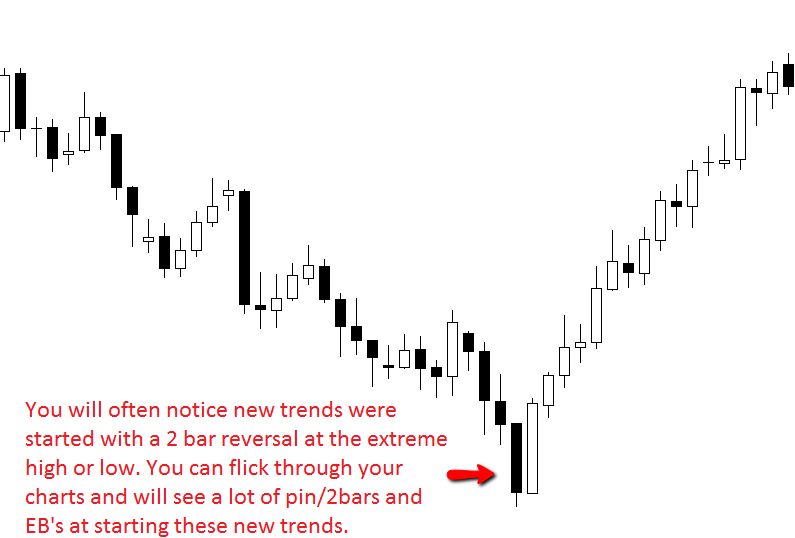

2 Bar reversals should be played from the same areas and managed the same as Pin Bars. As the name suggests the 2 bar Reversal is a Price Actions signal that hints at a reversal, so we must play these from swing points and value areas.

Example of 2 Bar Reversal

Examples of 2 Bar Reversals in Play

Example #1:

Example #2:

Example #3:

Example #4:

Example #5:

Creating Extra chart Time Frames

There is an indicator that can be attached to MT4 that allows the user to blend candles together to see what the candles look like together.

For example; you may have a 2 bar reversal (2 bar pin bar) and when you apply the candle blending indicator it may show a clean pin bar on your chart by matching the two candles together.

The downfall of this indicator is however, you don’t get to select what candles you would like to blend so it becomes chance whether the two candles in your 2 bar reversal will show up. You can find more info on this indicator and also about using the correct New York charts HERE.

This is a super handy indicator not only for 2 bar reversals, but for hunting trade setups on 2 day, 12 hour, 8 hour, and 2 hour charts also!

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[/custom_html][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Seven

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 10 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

Action Steps & Downloads / Links

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

Complete Module Test

[/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]