[op_liveeditor_element data-style=””]

LESSON: Entry and Stop for Inside Bars

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]In the Forex world there is many different techniques used for both the entry and the stop. Like everything we do at Forex School Online both our entries and stops are logical and designed for the best results.

Entry of the inside bar should always be when price has confirmed the signal. For this confirmation to happen we need to see the housing candles high or lows taken out by price.

It is not enough that the inside candles have its high or lows broken because many times price will break the inside candles high or low and then reverse and the housing candle stay unbroken.

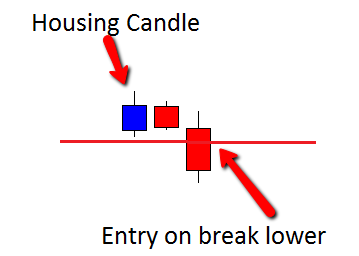

CHART EXAMPLE #1:

An example of entry is below. The trade was triggered when price broke the housing candle low.

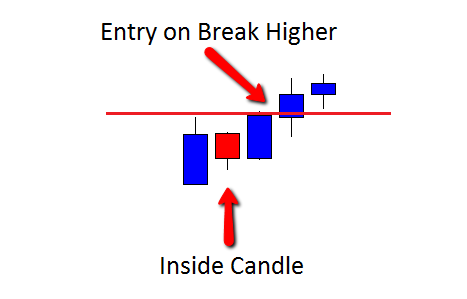

CHART EXAMPLE #2:

An example of entry long is below:

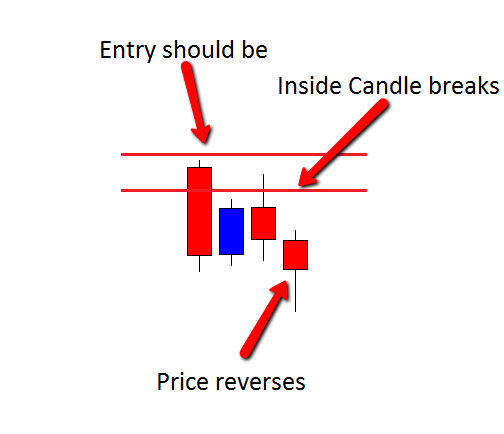

CHART EXAMPLE #3:

An example of price breaking the inside candle, but not the housing candle and then reversing is below.

This is why it is important to wait for the housing candle to break.

There are two methods for stop placement traders can use which are:

- Stop above below other side of the housing candle

- Stop above below the other side of the inside bar

The stop above or below the other side of the housing candle is the conservative stop.

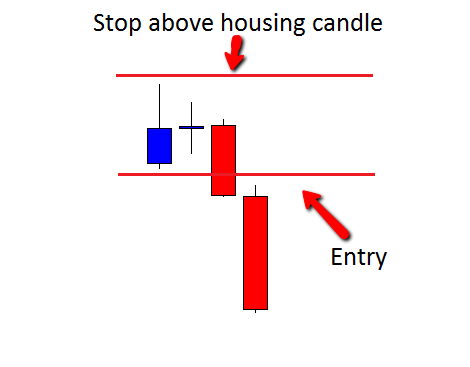

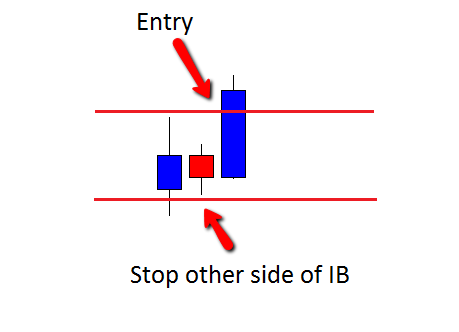

CHART EXAMPLE #4:

An example of this type of stop is below:

CHART EXAMPLE #5:

The stop on the other side of the inside candle can be used to increase the potential risk reward of the trade.

An example of this stop is below:.

[/text_block][/op_liveeditor_element]

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Two

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 6 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]