[op_liveeditor_element data-style=””]

LESSON: Entering the Engulfing Bar

[/op_liveeditor_element]

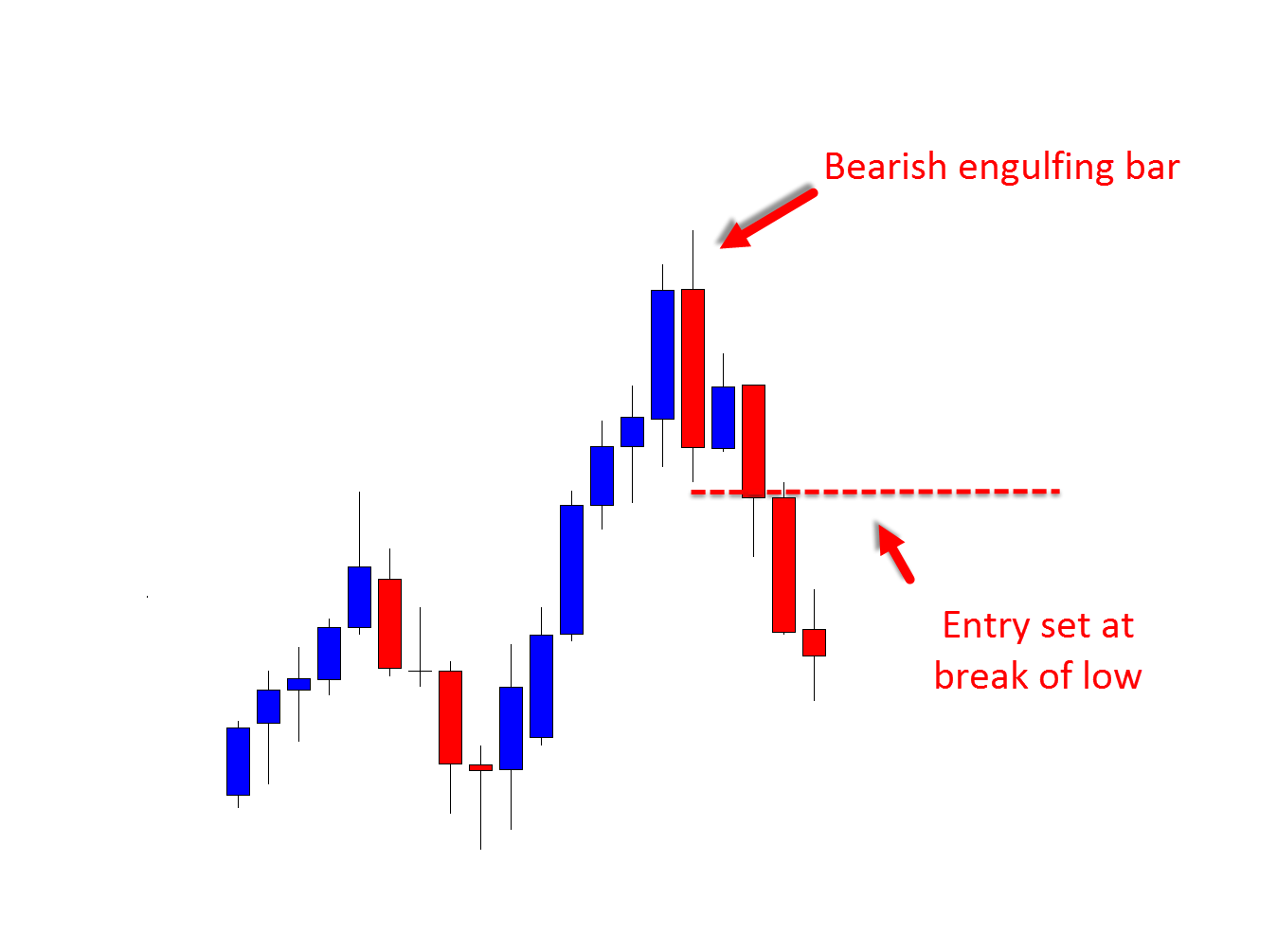

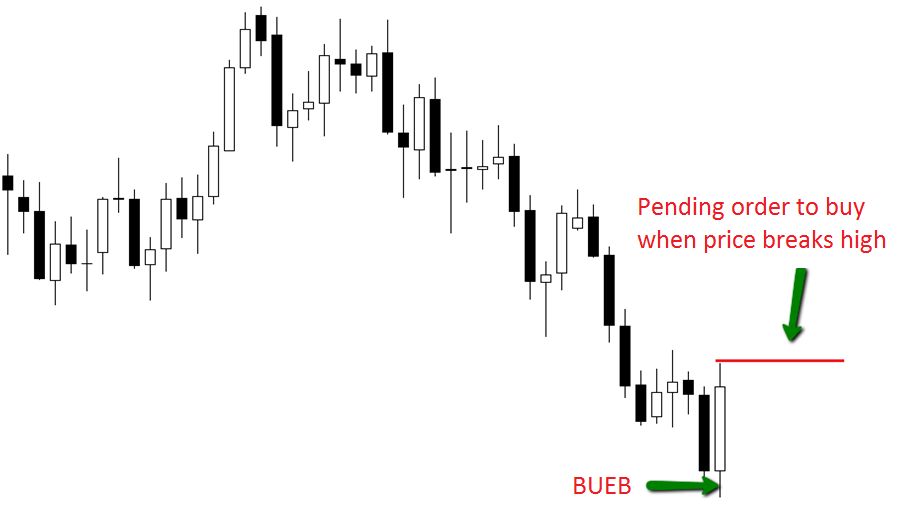

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]There are two ways to enter the Engulfing Bar. The most favorable and also the most successful method of entry is when price breaks the high or the low of the Engulfing Bar.

This method of entry is the safest and often saves traders from entering into trades that reverse back to become losers. This is the method that is advised that new traders should use until they are profitable.

After they are profitable they can look at the next method.

To enter this way, all the trader must do is set pending orders above or below the high of the engulfing bar so that when price breaks the high or low the trader is entered on the break. (Just the same as taught with the pin bar).

Some traders get confused with this so I will try to clarify it; Once the engulfing bar has finished forming and has closed you should then work out your trade and immediately set your orders and put them into your broker – NOT before it has closed.

You are then looking for price to go on and break the engulfing bar high or low and hit your pending entry orders and put you into the trade. You don’t need price to close above the high or low of the engulfing bar.

To clarify: Once the engulfing bar has closed, you set your orders to enter.

The amount of pips spread and how to use buffers for your entries etc is discussed in the members only article tips and tricks which can be found HERE . You will always be setting your orders to enter on the break using buy and sell stops. Please read the member’s tips and tricks article for more information on this.

Chart Examples:

Chart example of entering at the break of the Engulfing Bar.

Using More Advanced Retrace Entry Method

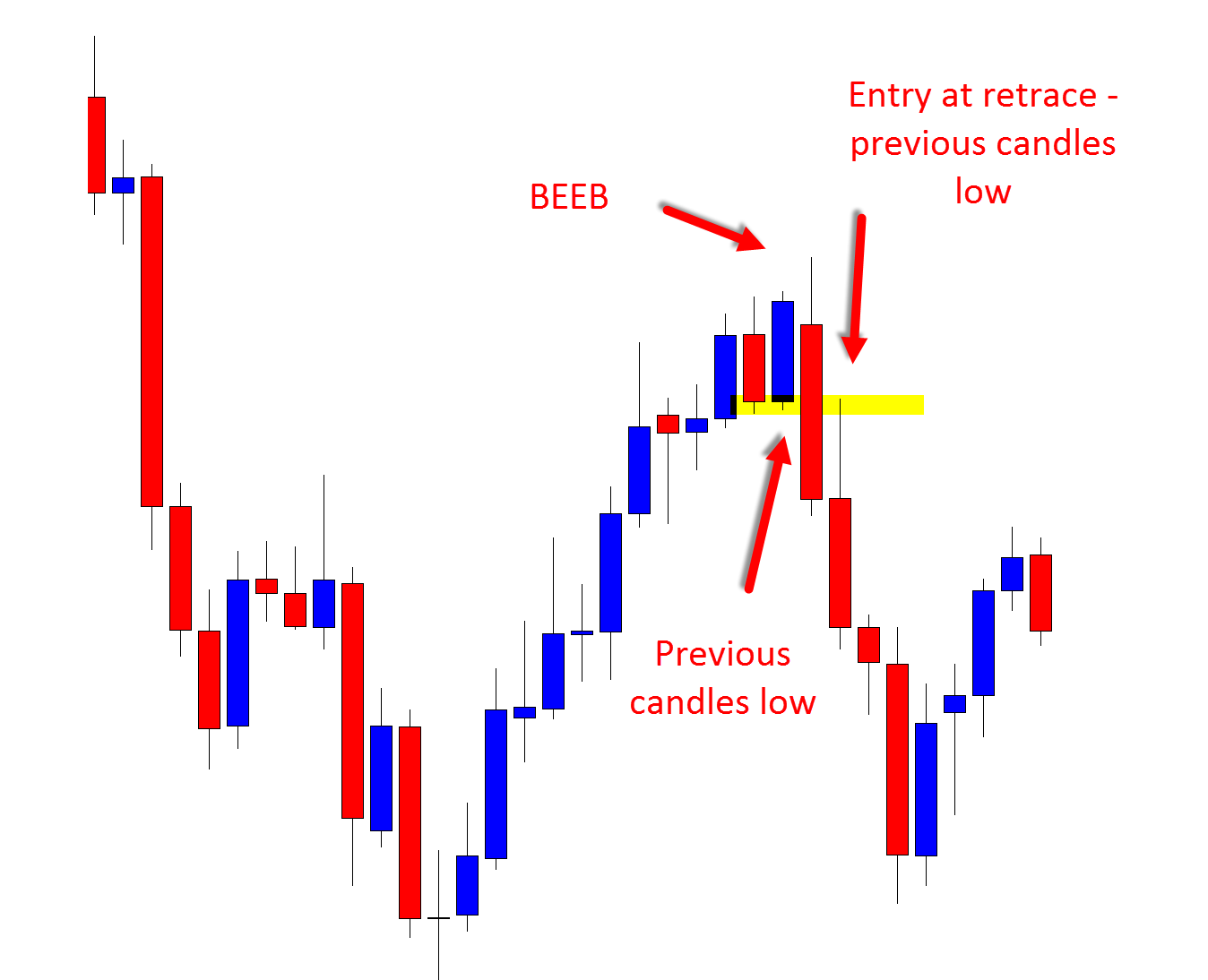

The second and much more advanced entry is an entry from a retrace.

This is the only price action set up to take a retrace entry on and the reason for this is sometimes on occasions the stop on Engulfing Bars can be extremely large and also because the way the engulfing bar is structured it allows us at times a perfect retrace opportunity.

We must be careful when doing this to pick our trades very selectfully! This is not how we want to enter all Engulfing Bars, only those few setups that present us with a great opportunity to do so.

MAJOR NOTE:

To take the retrace entry we don’t just enter anywhere, or we just don’t set a random figure and jump on in.

When taking a retrace entry with the engulfing bar we use the previous candles high or low. This previous candle high or low will often act as a new support or resistance point and whilst it only looks as one candle low on the chart we are trading, if we move to a smaller time frame chart, it will look like a whole swing point and support/resistance area and this is why when we take a retrace entry from it, it now acts reliably as a new support and resistance flip area for us to trade from.

We must always remember we are price action traders and NOT gamblers. EVERYTHING we do is around price and not random. It is based in creating an edge and with a business mindset.

We use price action for everything we do. We do not just take random retrace entries. If you are going to take a retrace, then be methodical about it and use price.

Target the recent high or low and use the logical method. Keep in mind you are often better off taking the entry at the break because this gives you the confirmation and then using other methods to shorten your stop, rather than taking a retrace.

You must keep this in mind as you weigh up which is better before taking the trade if indeed you do take the trade.

Even if you don’t take the retrace entry, keep these levels in mind during the trade. If price moves back, or if you are moving your stop higher etc,.

See the charts for further explanation:

Lastly…

We must remember with the retrace entry, we only rarely use it and we only take an entry via retrace when the market gives us the opportunity.

The worst thing you can do is bend the market to you and what you want.

What does this mean? You see a trade that you like, but you think the stop is too big and so you ‘fudge’ a retrace that is no where close to being there just to get into the trade the way you want to and to make the trade fit as you want it.

The retrace is either there or it isn’t. Take the market and the opportunities as they come.

And…

Make sure like all the methods and setups discussed in this course, you demo, demo and demo some more before ever considering using your own money.

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

Trading the Best Price Action Retrace Entries on the EB:

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Seven

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 30 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

Action Steps And Downloads / Links

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

Watch Video

[/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]