[op_liveeditor_element data-style=””]

LESSON: Managing Against Trend

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]With the “against the trend” trade it is similar to trading in a range, in the way that we are never going to be looking for runners.

Normally when trading against the trend there will be a very logical support or resistance area that price will look to pull back to before continuing on in the trend direction. This is the area that I am generally looking to take my profit.

I personally manage the trades against the trend very tightly because price can turn at anytime and continue back in the trend direction which they are normally looking to do. I am also always looking to protect my capital when trading against the trend.

Examples…

An example of how I may manage a trade with against trend is:

- Open 2 positions

- Both positions moved to breakeven when price hits the first area

- No profit taken at first area (unless this is logical area for price to continue in trend direction)

- Full profit taken at the logical area price will likely go back in trend direction

The reason I have two positions with this management when I only take one profit is because I like to be able to have a position to use up my sleeve if I do want to use it.

As I said all things can change and I like to have the option to protect capital or take part profits.

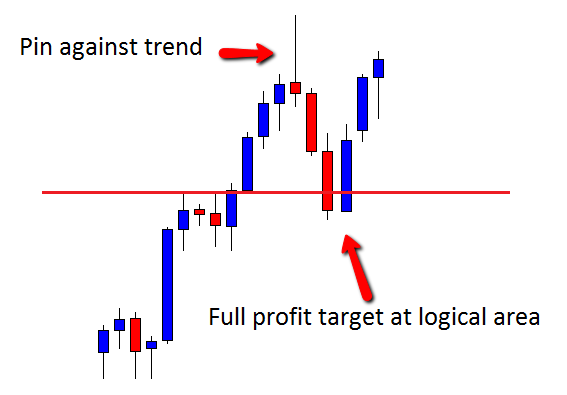

CHART EXAMPLE #1:

An example of a trade against the trend is below. A Pin Bar formed against the up-trend. There was a logical area for price to continue this uptrend and this is where I would look to take full profit.

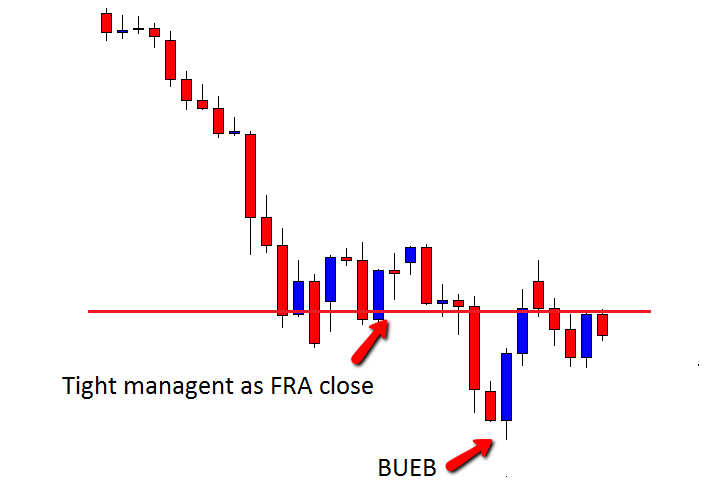

CHART EXAMPLE #2:

In this chart example below we are entering of a BUEB against the trend.

In this case the first resistance area and logical area for price to turn are the same. Because of this the trader would either skip this trade or enter and take profit early using the management technique discussed.

[/text_block][/op_liveeditor_element]

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Five

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 8 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]