[op_liveeditor_element data-style=””]

LESSON: The Reversal Candle

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]Reversal candles are candles such as Pin Bars and Engulfing Bars.

Reversals bars can also come in the form of candles that are not quite Pin Bars, but candles that have large rejection wicks on them.

When we are trading reversals a trigger it is crucial they conform to a set of rules and set criteria.

However, when managing trades with price action and reversals, these reversal candles are more about looking for the clues or the reversal the the reversal in price against our positions, rather than a text book pin bar that has an perfect open and close.

NOTE: Make sure this trade management method is used at the right times. Two examples of this could be;

- You make a breakout trade and there is not previous support or resistance back to the left to set profit target with and so you manage your profits with price action.

- You manage your last position of your trade to try and ring as much profit as possible out of the trade as you can after all previous targets of pre-trade plan have been hit.

Whilst the previous two topics have been about looking to mainly maximise profit, learning how to identify and manage the reversal candles can be the key to minimising the downside of a loss.

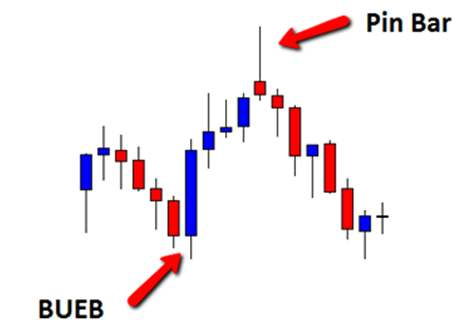

CHART EXAMPLE #1:

Below is an example of how a Bullish Engulfing Bar (BUEB) broke out and went higher. Price then formed a not quite Pin Bar reversal.

This was a not quite Pin Bar as it did not open and close within the previous bar. Even though it did not meet the criteria for a pin bar a clever price action trader would have known enough to know that trouble was brewing for long traders and they would have been protecting their capital (you don’t have to run scared at first sign of every reversal candle and jump out of every trade!. You can protect capital).

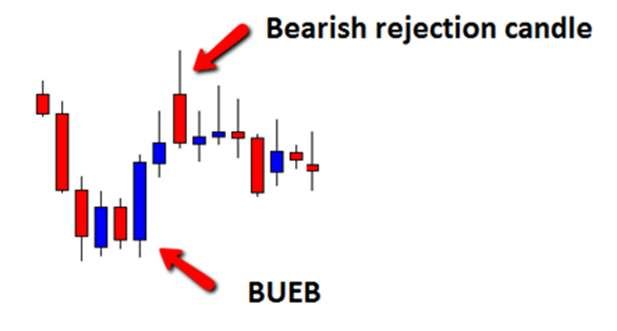

CHART EXAMPLE #2:

The second example is of a similar pattern. A Bullish Engulfing Bar sends price higher and this time a bearish rejection candle forms. The smart price action trader would be all over this and would be on high alert as to how this could play out.

There are two options for the trader in this position. They could just cut their trade and be done with it happy with their profit, or they could decide to bring their stop right up under the bearish rejection candle and see if price does fall back lower.

[/text_block][/op_liveeditor_element]

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Four

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 6 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]