[op_liveeditor_element data-style=””]

LESSON: Examples of Using Fibonacci

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” font_size=”16″ font_font=”Montserrat” font_color=”%237e7e7e”]To mark the Fibonacci we place it from the extreme high to the extreme low of recent swing points or vice versa depending on the trend.

For example; in a downtrend we start by marking the Fibonacci from the extreme high to the low. Just remember whichever way the trend is going is the way we put the Fibonacci tool. So if the trend has gone from high to low that’s what we do with Fibonacci. If the trend has gone from low to high, that’s the way we put the Fibonacci.

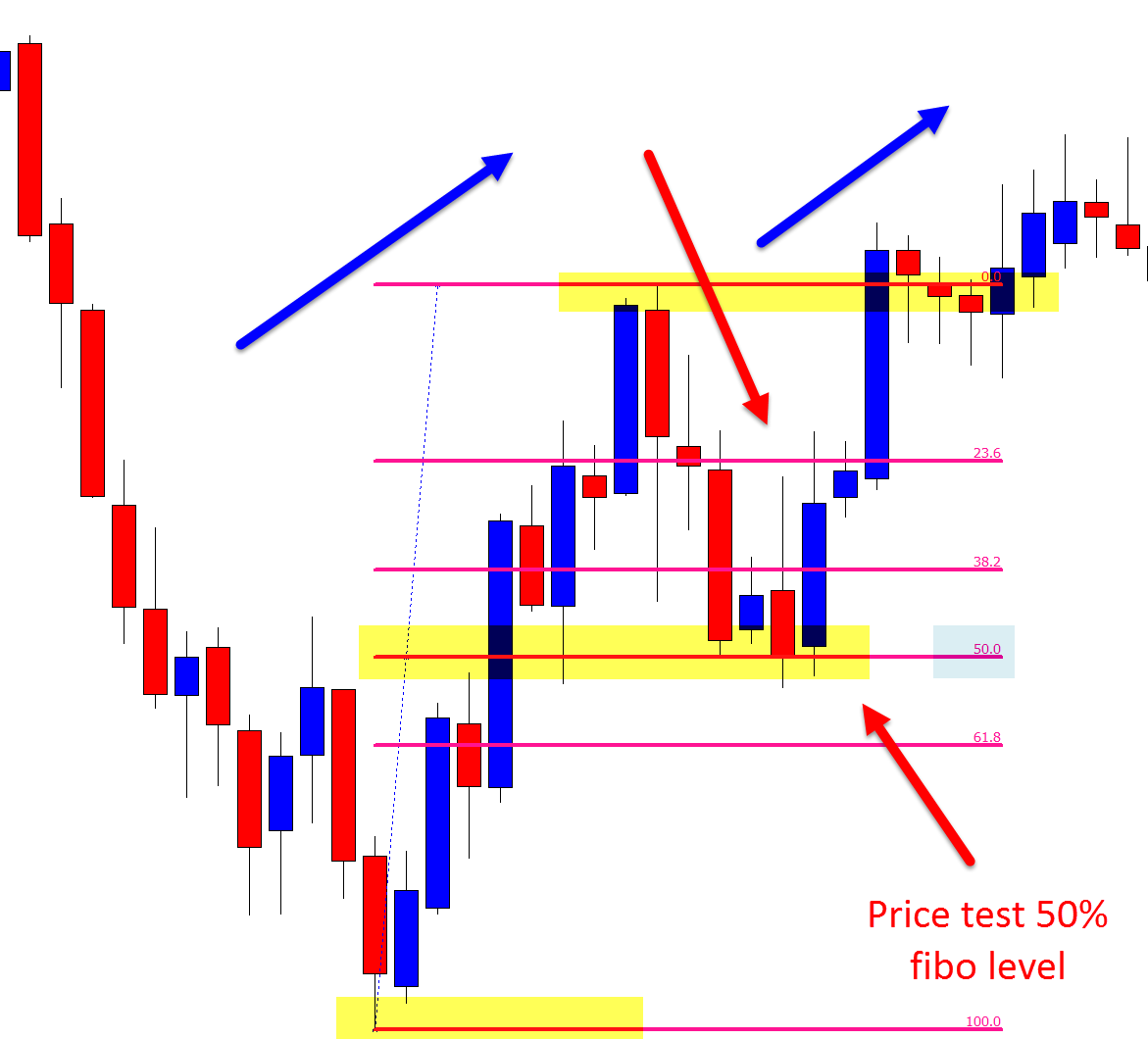

Example #1 in Uptrend:

For the uptrend we place the Fibonacci from the extreme low to the high. Note how price retraced in the uptrend and touched the 50% level before again going higher with the trend.

It is at the swing and 50% pull-back in real-time we could hunt for long trades on this and smaller time frames with the trend higher.

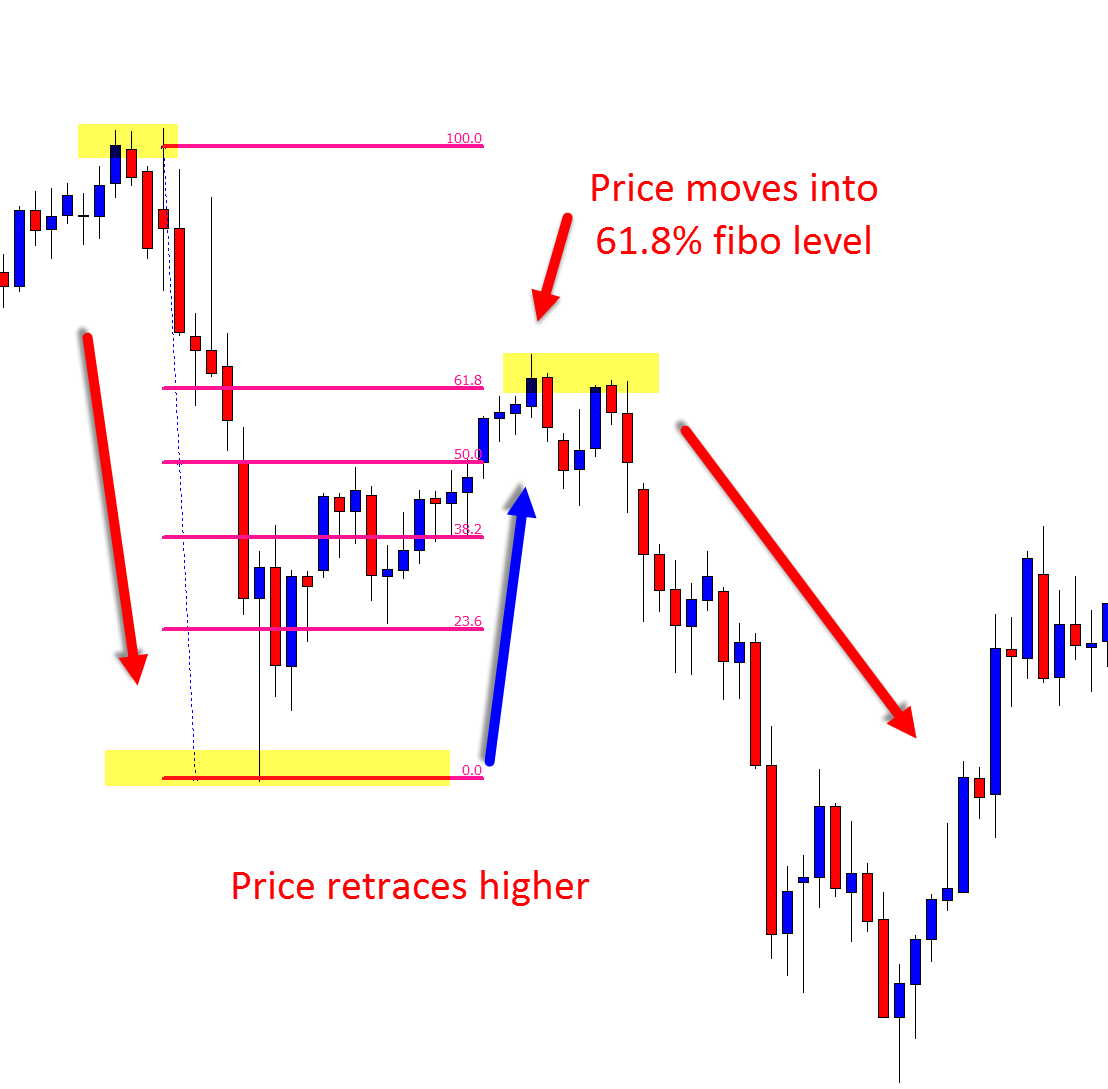

Example #2 in Down Trend:

For the downtrend we place the Fibonacci tool from the high to the low.

In the chart below price respected the 61% level and could not close above it. Price ended up rejecting and making a move back lower.

NOTE:

In the next lesson I am going to teach you how you can mark up you stop levels using the Fibo tool, but keep in mind with your general Fibo placement and all round use of this tool, it is to used as an added confluence an added ‘tick in the box’ and not as a decision maker by itself.

You should not be making trades at Fibonacci levels alone. They should be backed up with other things like, support/resistance, VBRN’s, and other points of confluence.[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” font_size=”25″ font_font=”Source%20Sans%20Pro” font_style=”bold”]

Module Nine

[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Duration: 4 mins[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”left” bottom_margin=”10″]Module Progress:[/text_block][/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””]

[/op_liveeditor_element]

[op_liveeditor_element data-style=””][text_block style=”style_1.png” align=”center” top_padding=”6″]« Previous Lesson[/text_block][/op_liveeditor_element]

[op_liveeditor_elements][/op_liveeditor_elements]